/

Questions/

Coursework/

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year: Corporate Finance Coursework, QMUL, UK

Looking For Plagiarism Free Answers For Your UK College/ University Assignments.

BUY NOWThe global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year: Corporate Finance Coursework, QMUL, UK

| University | Queen Mary University of London (QMUL) |

|---|---|

| Subject | Corporate Finance |

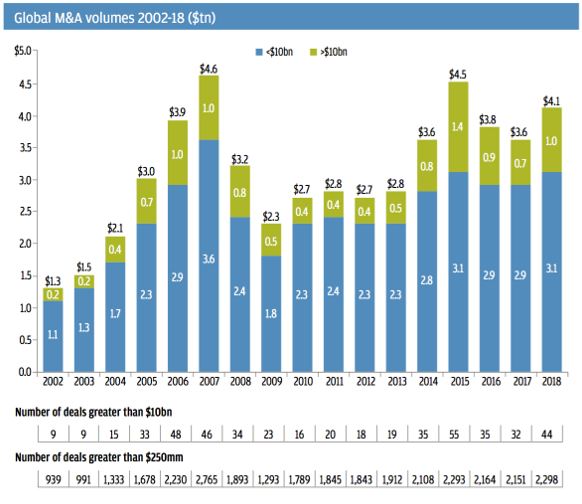

The global M&A; market remained strong in 2018 with announced transaction volumes reaching $4.1 trillion, the third-highest year ever for M&A; volumes. The announced volume in the first half of 2018 was robust, representing the second-highest first half of all time. The activity was largely driven by “megadeals”.

Thirty megadeals were announced in the first six months of 2018 — the highest first-half megadeal count on record — compared with 14 deals in the first half of 2017. The number of megadeals began to normalize throughout the second half of the year, although they continued to be a significant driver of activity in 2018.

While megadeals were a large driver of M& A-announced dollar volumes in 2018, the count for deals greater than $250 million also increased by 7% from 2017, with activity remaining robust across all deal types. The activity was brisk across domestic and international deals, strategic and private equity, and all sectors, with technology and healthcare representing the largest contributors to global volume in 2018. Private equity funds continued to have ample “dry powder” and deployed this capital throughout 2018; sponsor buy-side volume was up 9% YOY.

Several of the key drivers and catalysts of M&A; A have continued from prior years. Positive global growth, improving cash flows, strengthening balance sheets, low cost of debt, investor support, and CEO confidence all continued to boost M&A; activity. The biggest new tailwind this year was the implementation of tax reform in the U.S., which helped generate incremental cash flows and provided access to overseas funds.

Innovation, disruption, and the need for growth also contributed to M&A activity, driving change across industries, geographies, and organizations. An accelerating rate of disruption has driven the need to act with urgency. As a result, new consumption patterns, new platforms, and new business models are resetting the basis of competition, redistributing industry economics, and reallocating value. We’ve seen a drastic increase in the technology sector over the past decade, more than doubling its share of the overall M&A market as the sector continues to innovate to meet changing demands.

While geopolitical uncertainty was prominent throughout the year and created many headlines, it had a limited effect on deal volumes in the first half of the year but may have contributed to the deceleration of activity toward the end of 2018. Meanwhile, cross-border M&A volume remained strong, accounting for 30% of the total M&A market, but with a different mix: China’s outbound M&A continued to decline, while Japan’s outbound M&A was robust throughout the year, with a record $184 billion in announced volume and a record number of deals larger than $1 billion. However, Japan’s activity benefitted disproportionately from Takeda Pharmaceutical’s acquisition of Shire for $81 billion.

Are You Looking for Answer of This Assignment or Essay

Get help by expert

UK students enrolled at Queen Mary University of London (QMUL) can benefit from our exceptional academic services. We specialize in providing Finance Assignment Help and reliable assignment writing help specifically tailored to the field of Corporate Finance. Whether you need assistance with your Corporate Finance Coursework or any other related assignments, our team of experts is here to support you. In an era where the global M&A market continues to thrive, with transaction volumes reaching $4.1 trillion in 2018, it is crucial to understand the complexities of corporate finance. By paying for our services, you can access the expertise of our skilled professionals, ensuring excellence in your coursework. Trust us to assist you on your academic journey and help you achieve remarkable results in the field of finance at QMUL in the UK.

Recent solved questions

- ILM: Assess own leadership behaviours and potential in the context of a particular leadership model and own organisation's working practices and culture: Leadership skills and development, Assignment, UOA, UK

- ILM: Describe the factors that will influence the choice of leadership styles or behaviours in workplace situations: Leadership skills and development, Assignment, UOA, UK

- ATHE Level 7 Unit 5 : You Have Been A Senior Manager For Several Years And Have Decided That Your Next Career Move Should Be To Take Responsibility: Personal Development for Leadership and Strategic Management Assignment, UK

- You are required to prepare a 5-year strategy review to shareholders for evaluating the business simulation: 5-year strategy review to shareholders, Report, UOEL, UK

- CMI Unit 502: Approaches to achieving a balance of skills and experience in a team: Principles of Developing, Managing and Leading Individuals and Teams, Assignment, UK

- CMI Unit 502: Principles of Developing, Managing and Leading Individuals and Teams, Assignment, UK

- UNIT-701: How the principles of strategic leadership can be applied to respond to complex organisational challenges: Strategic Leadership, Assignment, CMI, UK

- UNIT- 701: The leadership behaviours and skills required to deliver strategic goals: Strategic Leadership, Assignment, CMI, UK

- UNIT- 701: Understanding of how the organisational context influences management and leadership practice: Strategic Leadership, Assignment, CMI, UK

- Evaluate the concept of evidence-based practice and assess how approaches to evidence-based practice: Evidence - based practices, Report, UOH, UK