- ATHE Level 4 Unit 12 Web Design Assignment: CTO Birdwatching Message Board Using Full-Stack Development

- ATHE Level 4 Unit 15 Software Testing Assignment: TDD & BDD Strategies for Python-Based Medical Data Validator

- ATHE Level 4 Unit 21 Computing Project Assignment: E-Learning Platform Design & Planning for Scalable Online Education

- CMI Level 521 Assignment: DKM&X Case Study for Data-Driven Decision Making

- ATHE Level 7 Financial Reporting Assignment: Ethics & Group Statements Case Guide for Trainee Accountants

- Public Health Poster Assignment: Historical and Organisational Analysis in a National Context

- CMI Level 5 Operational Plan Assignment: CMI Case Study on Delivering Strategic Goals in a Large Organisation

- CIPD 7C001 Assignment: Explore Key Trends, Tech Impacts, Change Models & Bias in People Management

- 7CO02 CIPD Level 7 Assignment: Strategic & Ethical People Management Practices Across Sectors

- CIPD level 5HR02 Assignment: Talent Management and Workforce Planning Unit Guide

- Level 3 D/615/3823 Assignment: Regulation, Protection, and Collaborative Practice in Health and Social Care

- ILM Level 4 Assignment 01: Developing Leadership Styles: An Action Plan for Effective Leadership and Team Engagement

- Level 6 Unit T/615/2726 Assignment: Strategic Project Management: Identifying, Planning, and Controlling Projects for Business Success

- EDD-U1-T4 Assignment: Internal and External Support Services for Educational Practitioners

- Discussion Paper on Market Forces and Government Interventions for Business Leaders

- Unit 10 Customer Relationship Management Assignment – CRM Processes & Stakeholder Roles

- CIPD 7HR02 Resourcing and Talent Management to Sustain Success

- Athe Level 3 Health and Social Care Assessment Questions

- M/618/4168 Unit 2 Principles, Values and Regulation in the Health and Social Care Sector – ATHE Level 3

- ILM Communication Skills Self-Assessment

Calculate the following for your company and provide the screenshot of your answers if you use excel: Real Estate Asset Management Assignment, UOM, UK

| University | University of Manchester(UoM) |

| Subject | Real Estate Asset Management |

Question 1

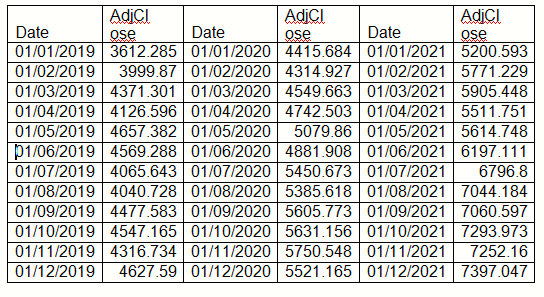

The adjusted Closing price for AppleIncis provide in the following table

Calculate the following for your company and provide the screenshot of your answers if you use excel. If you use a calculator please show all your calculations:

Calculate the Holding Period Returns for 2019,2020 and 2021.

Calculate the Annual Standard Deviations for 2019,2020 and 2021.

- AssuminganannualRisk-FreeRateof1.5%,whatwastheRiskPremiumforeachofthethreeyears?

- WhatwastheSharpeRatio ineach of the three years?

- Calculate and explain the results of your allocated company’s Capital AllocationLineoverthefull3-year period.

Question 2

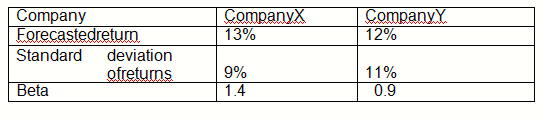

The T-billrateis 3.5% and the market risk premiumis 8%.

What would be the fair return for each company according to the capital asset pricing model (CAPM)?

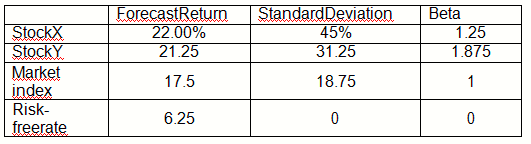

Jony Depp, a fund manager at Fidelity McGillan fund, is using the capital asset pricing model for making recommendations to his clients. He has produced the information shown in the following exhibit.

Identify and justify which stock would be more appropriate for an investor who wants stood his Stockton a well-diversified equity portfolio. Which stock would be more appropriate for a single-stock portfolio? Explain your answers.

Buy Answer of This Assessment & Raise Your Grades

Excelling in Real Estate Asset Management: University of Manchester (UoM) students can now access top-notch Online Assignment Help at unbeatable prices! Diploma Assignment Help UK brings you a Cheap Assignment Help Service tailored for your academic success. Unleash the potential of your assignment with our expert guidance and ensure a bright future in the real estate industry.