- Qualifi Level 6 BA601 Management Control Assessment Brief 2026 | UEL

- BTEC Level 4 Unit 02 Engineering Mathematics Assessment Brief 2026

- UNIT 305 Assessment Booklet: The aim of this assessment booklet is to enable managers to evidence their understanding of how to use their knowledg: Building Stakeholder Relationships Using Effective Communication, Assignment, UK

- You are working as an assistant in a small business advisory service. Esah, who wants to start her own fitness business: UNIT 7: Business Decision Making, Assignment, OC, UK

- You have recently joined a small electronic circuit manufacturing company as a quality manager: Pearsons BTEC HNC level 4 Assignment, SEC, UK

- You are working in a small engineering company as a trainer designer, and your supervisor: Egypt Assignment, OU, UK

- BTEC Level 3 Unit 13 Welding Technology Assignment Brief 2026 | Pearson Qualification

- CIPD 5HR02 Talent Management and workforce planning Assessment Questions 2026

- CIPD Level 5 5HR01 Employment Relationship Management Assessment Question 2026

- Level 5 Certificate and Diploma in Effective Coaching and Mentoring Qualification Assessment

- NVQ Level 6 Diploma Unit 604 Organisational Health and Safety Policy Assignment 2026

- Unit 3 Effective Decision Making in Adult Care Diploma Level 5 Assignment Questions 2026

- QUALIFI Level 3 BM303 An Introduction to Marketing Assignment Brief 2026 | SBTL

- 7PE617 Principles of English Language Teaching Assessment Brief 2026 | UDo

- Othm Level 3 Foundation Diploma In Health And Social Care Assignment Brief

- Level 2 Award Leadership and Team Skills Assignment 1 2026 | ILM

- NVQ Unit 2 Manage Personal and Professional Development Assignment

- ATHE Level 6 Unit 18 Human Resource Management Assignment Brief

- Unit 321 Managing Own Personal and Professional Development Assessment | BCU

- CIPD Unit 5CO01 Organisational Performance and Culture in Practice Learner Assessment Brief 2025/26

Sweets Are plc is an Iona-established sweets and confectionery manufacturer. All products are manufactured in the: Accounting Fundamentals Assignment, CU, UK

| University | Conventry University (CU) |

| Subject | Accounting Fundamentals |

Question 1

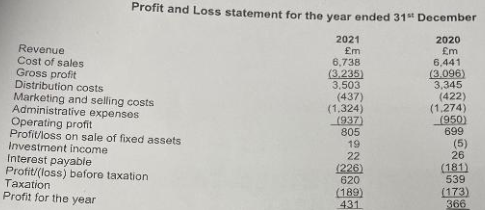

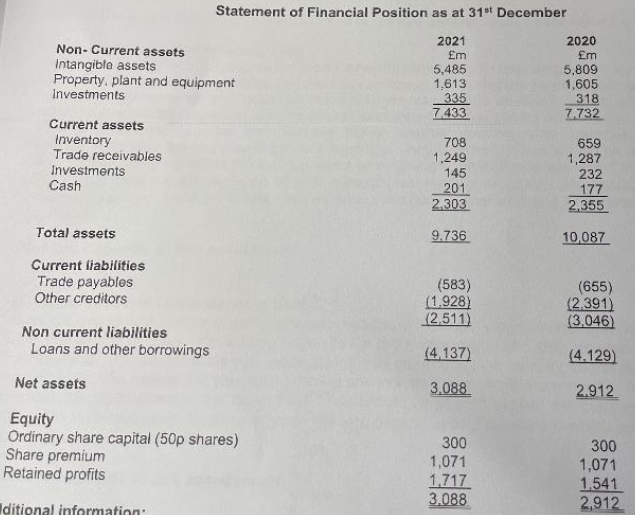

Sweets Are plc is an Iona-established sweets and confectionery manufacturer. All products are manufactured in the, UK. but sales are made worldwide. It is a growing but competitive market. Given below are extracts from their financial statement.

Question 2

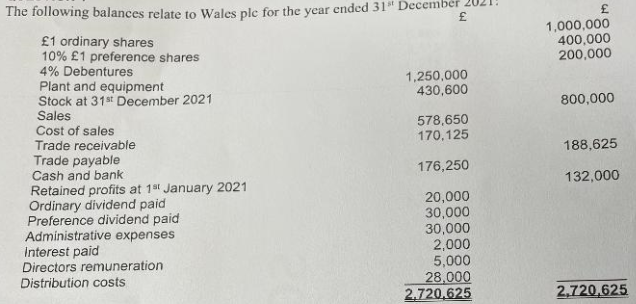

The following balances relate. to Wales plc for the year ended 31″ Member 2021:

The following information is relevant:

- Corporation tax for the year is estimated at £100.000.

- Salesmen are owed a commission of £3,000 in respect of December sales. It will be paid on 31 January 2022 and has not been recorded in the ledger accounts yet.

- Goods valued at £980 were sent to customers on 31St December 2021. Payment is due on 28 February 2022. This has not been recorded in the ledger accounts yet.

- The preference shares should be included within equity.

Buy Answer of This Assessment & Raise Your Grades

Seeking online assignment help for your accounting fundamentals assignment in the UK? Diploma Assignment Help UK is your go-to solution! Our qualified team of accounting professionals specializes in providing personalized assistance to students like you. From analyzing financial statements to solving complex accounting problems, we offer comprehensive support that ensures your assignment meets the highest academic standards. Don’t let accounting concepts overwhelm you – trust Diploma Assignment Help UK to deliver accurate, well-structured, and timely accounting assignment solutions tailored to your needs